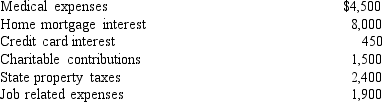

George has the following expenses that he wants to include as itemized deductions for the year.His adjusted gross income is $60,000.What is the total itemized deduction he can take? (Show all work. )

Definitions:

Television Advertising

Is a marketing strategy that uses TV commercials to communicate messages about products or services to consumers.

Jingles

Short, memorable songs or tunes used in advertising to convey a product's attributes or benefits and to increase brand recall.

Advertising Wearout

The phenomenon where an advertisement loses its effectiveness due to repeated exposure over time, leading to audience boredom and a decline in response rates.

Advertising Burnout

A situation where consumers become indifferent to advertising messages after being exposed to excessive amounts of advertising.

Q1: [Stocks | Your house] would be considered

Q22: Your tax filing status [would | would

Q29: Your marital status [will | will not]

Q32: In order to find out all of

Q60: Mortgage interest and paid home property taxes

Q62: Your auto loan payments would be listed

Q99: With most ARMs,the interest rate over the

Q101: Budgets should be prepared on an accural

Q129: Your gross income was $32,000;your net income

Q147: I should not record _ on an