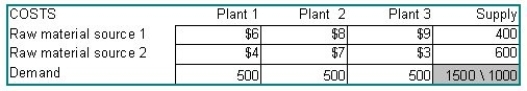

A firm has established a distribution network for the supply of a raw material critical to its manufacturing. Currently there are two origins for this raw material, which must be shipped to three manufacturing plants. The current network has the following characteristics:  The firm has identified two potential sites for a third raw material source; these are identified as Candidate A and Candidate B. From A, the costs to ship would be $9 to Plant 1, $10 to Plant 2, and $12 to Plant 3. From B, these costs would be $11, $14, and $8. The new source, wherever it is located, will have a capacity of 500 units. Set up-but DO NOT SOLVE- this problem as though you were going to solve it with transportation problem software.

The firm has identified two potential sites for a third raw material source; these are identified as Candidate A and Candidate B. From A, the costs to ship would be $9 to Plant 1, $10 to Plant 2, and $12 to Plant 3. From B, these costs would be $11, $14, and $8. The new source, wherever it is located, will have a capacity of 500 units. Set up-but DO NOT SOLVE- this problem as though you were going to solve it with transportation problem software.

Definitions:

Diluted Earnings Per Share

A performance metric that shows the quality of earnings per share if all convertible securities were exercised.

Complex Capital Structures

Refers to corporate financial structures that feature a mix of simple and intricate financial instruments, such as multiple classes of stock or convertible bonds.

Cash Dividend

A distribution of a company's profits to its shareholders in the form of cash.

Current Ratio

A liquidity ratio that measures a company's ability to pay short-term obligations with its current assets.

Q13: What limitation(s) do decision trees overcome compared

Q29: The factor-rating method can consider both tangible

Q35: Which of the following is most likely

Q37: Which of the following is true of

Q42: A metal works fabricator is about to

Q56: The transportation model seeks satisfactory, but not

Q60: Source A has capacity of 15, Source

Q102: Two manufacturers have very different learning rates;

Q103: Which of the following is not a

Q111: _ refers to the physical surroundings in