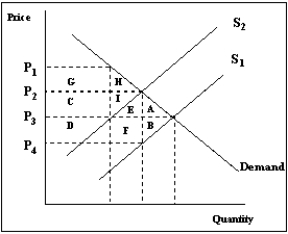

Exhibit 7-8

-Refer to the Exhibit 7-8. Suppose that the government imposes a sales tax on a good such that S1 represents the supply curve without the tax and S2 represents the supply curve with the tax. The deadweight loss as a result of the tax is the combined area of

Definitions:

Reconciliation

The process of ensuring two sets of records (usually the balances of two accounts) are in agreement.

Variable Costing

A costing method where only variable production costs are included in product costs, with fixed overhead expenses treated as period costs.

Contribution Format

A method of income statement presentation that separates fixed costs from variable costs to highlight the contribution margin.

Reconciliation Method

A process used in accounting to ensure that two sets of records (usually the balances of two accounts) are in agreement.

Q24: A competitive market is one in which

Q57: A price floor is<br>A)a minimum allowable price

Q64: A product with an elastic demand means

Q78: Some competitive firms are willing to operate

Q88: In the long-run competitive equilibrium model, capital

Q119: Total revenue will decrease if price<br>A)rises and

Q119: Refer to Exhibit 7-1. If Firm A

Q127: When diminishing returns to labor begins,<br>A)average total

Q139: Refer to Exhibit 6-8. Producer surplus in

Q172: Suppose that, as the price of product