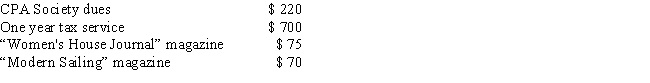

Catherine is a CPA employed by a large accounting firm in San Francisco. In the current year, she paid the following amounts: How much may she deduct on Schedule A as a miscellaneous deduction, before considering the 2 percent of adjusted gross income limitation?

Definitions:

Budgeted Overheads

The estimated costs for overhead (indirect costs such as utilities, rent, and administrative salaries) that are planned or budgeted for a specific time period.

Wage Payable

The amount of salary or wages that a company owes to its employees at the end of a financial period but has not yet paid.

Manufacturing Overhead

Indirect costs related to manufacturing that cannot be directly traced to specific products, such as factory rent, utilities, and equipment maintenance.

Overtime

Additional time worked beyond the standard working hours, usually compensated at a higher rate than regular hours.

Q4: A credit against the FUTA tax is

Q7: Cows used in a farming business are

Q11: Lorreta has a manufacturing business. In the

Q20: Which of the following tax credits is

Q54: Arthur is divorced with two dependent children,

Q56: Marco makes the following business gifts during

Q65: Passive losses are fully deductible as long

Q77: Bob owns a rental property that he

Q93: The Affordable Care Act (ACA) added a

Q97: Richard has $30,000 of income from a