Multiple Choice

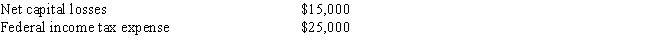

For the current year, the Beech Corporation has net income on its books of $60,000, including the following items: Federal tax depreciation exceeds the depreciation deducted on the books by $5,000. What is the corporation's taxable income?

Definitions:

Related Questions

Q17: Indicate which of the following dues, subscriptions,

Q21: The cost of a subscription to the

Q26: OLAP enables users to obtain online answers

Q34: Rob, Bill, and Steve form Big Company.

Q43: What technology allows people to have content

Q48: Which of the following statements about the

Q48: Penny, age 52, takes a distribution of

Q71: George, age 67, and Linda, age 60,

Q73: Oscar and Frank form an equal partnership,

Q76: The two types of exemptions are the