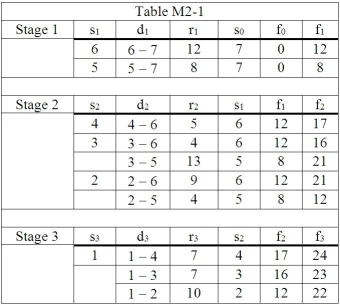

Table M2-1

The data below is a dynamic programming solution for a shortest route problem.

-Using the data in Table M2-1,determine the distance of stage 1 for the optimal route.

Definitions:

Form 941

A tax form used by employers to report quarterly federal payroll taxes, including amounts withheld from employees' paychecks and the employer's portion of social security and Medicare taxes.

Social Security

Government program that provides financial assistance to people with an inadequate or no income.

Medicare Taxes

Taxes collected from earnings to fund the Medicare program, providing health insurance to individuals aged 65 and older or those who meet specific criteria.

FUTA

The Federal Unemployment Tax Act, which imposes a payroll tax on businesses to fund state workforce agencies.

Q1: The second derivative tells about the slope

Q10: The constraint 5 X<sub>1</sub> + 6 X<sub>2</sub>

Q19: In a zero-sum game,what one player gains

Q19: Using EOL requires one to identify the

Q32: A feasible solution to a linear programming

Q78: Evaluate the determinant below. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2950/.jpg" alt="Evaluate

Q82: Transportation models may be used when a

Q84: In a maximization problem,if a variable is

Q86: An n × m matrix,when multiplied by

Q97: The linear programming truck loading model always