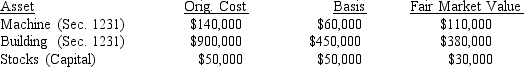

Casey Corporation has three assets when it decides to liquidate:  The corporation sells the stock for its fair market value and distributes the other two assets to its sole shareholder.What is its tax liability on its final tax return if it had $45,000 of income from operations prior to liquidating?

The corporation sells the stock for its fair market value and distributes the other two assets to its sole shareholder.What is its tax liability on its final tax return if it had $45,000 of income from operations prior to liquidating?

Definitions:

Negotiates

The process by which parties come together to try and reach an agreement on a matter, often involving discussion and compromise.

Fictitious Payee Rule

A legal principle that holds a drawer of a check responsible when funds are obtained by fraud, if the drawer fails to exercise caution in issuing the check.

Immediate Loss

Financial damage or cost incurred directly as a result of an event, action, or decision, without any delay.

Forged Instruments

Documents that are illegally altered or created to deceive or commit fraud.

Q21: What is a major advantage of the

Q30: What are the three types of freight

Q34: Soledad received one stock right for every

Q45: Which of the following is included as

Q48: The Willow Corporation reported $400,000 of taxable

Q50: An individual taxpayer has the following property

Q51: Weilin's gross estate was valued at $4,870,000

Q62: The all events test is met for

Q64: Jeremy purchased an asset for $12,000 at

Q72: All partnerships are passive activities.