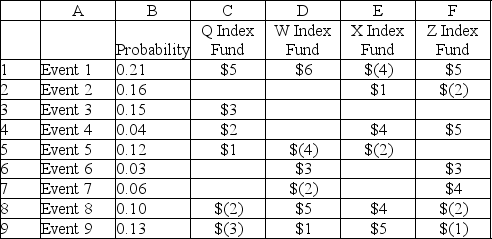

Use the table below to answer the following question(s) .

Below is a spreadsheet for a situation in which a day trader wants to decide on investing $200 in one of the index funds.  Answer the following questions using PHStat.

Answer the following questions using PHStat.

-What is the coefficient of variation of the Z index fund?

Definitions:

Market Risk

The risk of losses in investments caused by factors affecting the overall performance of the financial markets, also known as systematic risk.

Economic Outlook

An analysis or forecast of the future economic condition, including expectations for growth, inflation, and employment.

Coefficient of Variation

A statistical measure of the dispersion of data points in a data series around the mean, used to assess the relative risk of an investment.

Systematic Risk

The risk inherent to the entire market or market segment, also known as market risk, which cannot be eliminated through diversification.

Q5: What is the employee contribution at the

Q17: What is the standard deviation of the

Q18: The Holt-Winters additive model differs from the

Q41: Using Solver,determine the amount to be shipped

Q49: Why does global inequality affect women more

Q56: How will the formula to calculate A17

Q56: If an extra finishing hour was used,the

Q69: For the below given data,Reuben wanted to

Q78: Determine the time that you had to

Q83: What is a nonlinear optimization model?