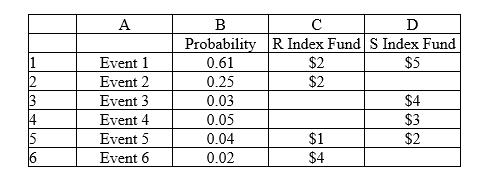

Below is a spreadsheet for a situation in which a day trader wants to decide on investing $150 in one of the index funds. Answer the following question(s) using PHStat.

-If the day trader groups the two funds in order to maximize the expected return while minimizing risk,what will be the portfolio expected return and portfolio risk?

Definitions:

Z-score

A statistical measure that describes a value's relationship to the mean of a group of values, measured in terms of standard deviations from the mean.

Finite Population Correction

An adjustment made to the standard formula for calculating sample size and variance when the sample size is a significant fraction of the total population.

Non-normal Probability Distribution

Describes a distribution of data that does not follow the normal distribution pattern, showing skewness or kurtosis different from a bell-shaped curve.

Central Limit Theorem

A fundamental statistical theory stating that, given a sufficiently large sample size from a population with a finite level of variance, the mean of all samples from the same population will be approximately equal to the mean of the population.

Q10: What is Trance Electronics' market share in

Q11: The assumption of homoscedasticity means that _.<br>A)variation

Q16: Identify and explain at least three of

Q31: Which of the following decisions is chosen

Q37: In a forecast chart provided by Crystal

Q52: Jenny downloaded the company's umbrella sales for

Q58: What is the process by which societies

Q82: A nonbinding constraint is one for which

Q82: In the NPV forecast chart generated after

Q94: Which of the following is the objective