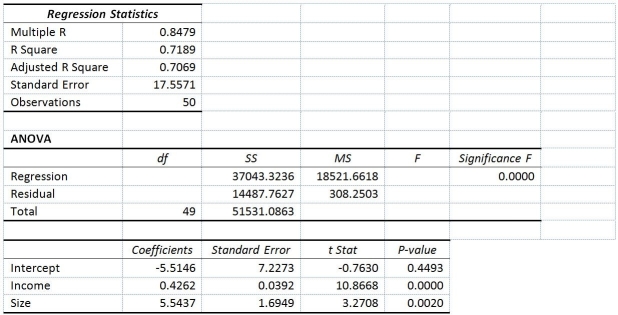

TABLE 14-4

A real estate builder wishes to determine how house size (House)is influenced by family income (Income)and family size (Size).House size is measured in hundreds of square feet and income is measured in thousands of dollars.The builder randomly selected 50 families and ran the multiple regression.Partial Microsoft Excel output is provided below:  Also SSR (X1 ∣ X2)= 36400.6326 and SSR (X2 ∣ X1)= 3297.7917

Also SSR (X1 ∣ X2)= 36400.6326 and SSR (X2 ∣ X1)= 3297.7917

-Referring to Table 14-4,________% of the variation in the house size can be explained by the variation in the family income while holding the family size constant.

Definitions:

Equity Method

An accounting technique used by companies to record investments in other companies, where the investment is initially recorded at cost and adjusted for the investor's share of the investee's profit or loss.

Non-Controlling Interest

The portion of equity in a subsidiary not owned by the parent company, reflecting minority shareholders' stake in the entity's net assets.

Equity Method

An accounting technique used to record investments in other companies, where the investment's value is adjusted based on the investor's share of the investee's profit or loss.

Acquisition Differential

The difference between the cost of acquiring a company and the sum of the fair market values of the identifiable assets acquired minus liabilities assumed.

Q1: If a group of independent variables are

Q12: The logarithm transformation can be used<br>A)to overcome

Q22: Referring to Table 16-14,in testing the coefficient

Q38: True or False: Referring to Table 14-17,we

Q61: Referring to Table 14-16,what is the value

Q66: Referring to Table 13-3,the total sum of

Q104: Referring to Table 13-12,the degree(s)of freedom for

Q108: Referring to Table 16-3,if this series is

Q137: Referring to Table 16-12,in testing the significance

Q137: Referring to Table 14-16,what is the correct