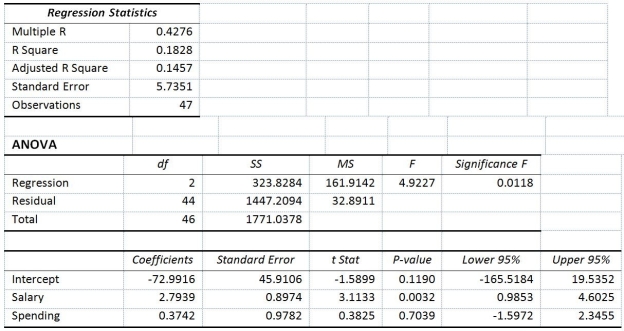

TABLE 14-15

The superintendent of a school district wanted to predict the percentage of students passing a sixth-grade proficiency test.She obtained the data on percentage of students passing the proficiency test (% Passing),mean teacher salary in thousands of dollars (Salaries),and instructional spending per pupil in thousands of dollars (Spending)of 47 schools in the state.

Following is the multiple regression output with Y = % Passing as the dependent variable,X1 = Salaries and X2 = Spending:

-Referring to Table 14-15,what are the lower and upper limits of the 95% confidence interval estimate for the effect of a one thousand dollar increase in mean teacher salary on the mean percentage of students passing the proficiency test?

Definitions:

Sensitivity Analysis

Investigation of what happens to NPV when only one variable is changed.

Capital Budgeting

The process in which a business evaluates and selects its long-term investments based on their potential financial returns.

What-If Questions

Hypothetical inquiries that explore outcomes of different scenarios, often used in planning and decision-making processes.

Net Present Value

The disparity between the current value of cash inflows and cash outflows over a certain timeframe, utilized to assess an investment's profitability.

Q30: True or False: When the parametric assumption

Q61: If we use the χ<sup>2</sup> method of

Q80: True or False: Referring to Table 12-6,there

Q92: Referring to Table 15-2,is the overall model

Q103: True or False: Referring to Table 12-2,the

Q125: Referring to Table 14-4,which of the following

Q137: Referring to Table 14-16,what is the correct

Q146: Referring to Table 12-5,what is the value

Q154: Referring to Table 14-2,for these data,what is

Q200: Referring to Table 14-19,which of the following