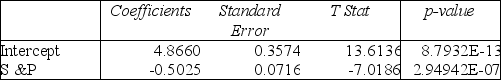

TABLE 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk.

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 index, is collected. A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance. The results are given in the following Excel output.

Note: 2.94942E-07 = 2.94942*10⁻⁷

-Referring to Table 13-7, which of the following will be a correct conclusion?

Definitions:

Meganational Strategy

A business strategy that emphasizes operating and competing in multiple countries as if they were a single global market.

Capital Investments

Expenditures by a company to acquire or upgrade physical assets such as property, industrial buildings, or equipment.

Personal Control

The use of frequent human interaction to enforce control.

Normative Control

Control that gets subunits to adhere to the values of the organization.

Q15: Referring to Table 12-8,which test would be

Q38: True or False: Referring to Table 14-17,we

Q49: True or False: Referring to Table 11-3,the

Q59: True or False: From the coefficient of

Q80: True or False: Referring to Table 13-10,the

Q83: True or False: Referring to Table 13-11,there

Q85: Referring to Table 15-6,what is the value

Q116: The width of the prediction interval for

Q134: Referring to Table 14-1,for these data,what is

Q307: True or False: Referring to Table 14-17,the