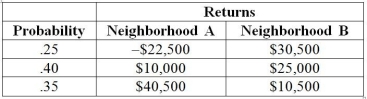

TABLE 5-7

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition. The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Table 5-7, if your investment preference is to maximize your expected return while exposing yourself to the minimal amount of risk, will you choose a portfolio that will consist of 10%, 30%, 50%, 70%, or 90% of your money on the house in neighborhood A and the remaining on the house in neighborhood B?

Definitions:

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life evenly, resulting in equal depreciation expenses per year.

Fixed Asset Turnover Ratio

An efficiency ratio that measures a company's ability to generate net sales from its fixed-asset investments, such as property, plant, and equipment.

Asset Impairment Loss

A charge recognized when the carrying amount of an asset exceeds its recoverable amount, indicating the asset's value has declined.

Net Book Value

The value at which an asset is carried on a balance sheet, calculated as the original cost minus accumulated depreciation and impairment costs.

Q68: +The amount of time required for an

Q85: Which of the following statements about the

Q88: The amount of time required for an

Q88: If the outcome of event A is

Q90: Referring to Table 4-1,what proportion of accidents

Q99: Referring to the histogram from Table 2-10,_

Q101: If events A and B are mutually

Q159: Referring to Table 6-3,what is the probability

Q164: True or False: Some business analytics involve

Q187: Referring to Table 6-2,John's commission from the