Silver Prices

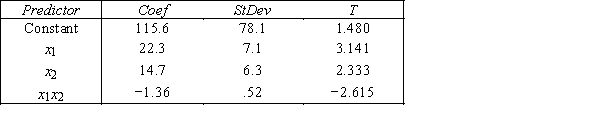

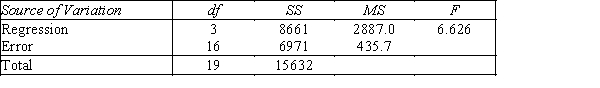

An economist is in the process of developing a model to predict the price of silver.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the first-order model with interaction: y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below. THE REGRESSION EQUATION IS y = 115.6 + 22.3x1 + 14.7x2− 1.36x1x2  S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

-{Silver Prices Narrative} Do these results allow us at the 5% significance level to conclude that the model is useful in predicting the price of silver?

Definitions:

Minor Infections

Infections that are usually mild, often easily treated or resolving on their own, such as a common cold or a minor wound infection.

Overprotected

Describes an individual, usually a child, who is guarded from potential risks or dangers to an extent that may limit their development or independence.

Bacteria

Microscopic, single-celled organisms that are abundant in most environments on Earth, serving various roles in ecosystems and human health.

Viruses

Microscopic infectious agents that replicate only inside the living cells of an organism, capable of causing various diseases.

Q8: {Game Winnings & Education Narrative} Use the

Q8: {Silver Prices Narrative} Is there sufficient evidence

Q16: A straight line regression model with only

Q31: If the plot of the residuals is

Q34: A nonparametric method to compare two populations,when

Q81: {Movie Scripts Narrative} What is the p-value

Q118: We can use the Friedman test to

Q118: {Computer Training Narrative} Use the quadratic model

Q157: When the Kruskal-Wallis test is used to

Q214: An inverse relationship between an independent variable