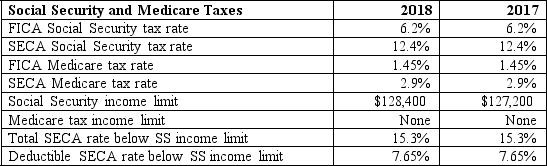

Jose worked at an architectural firm as an employee for the first four months of 2018 before he established his own business. He earned $53,300 at the architectural firm. His net income from his sole proprietorship was $78,000. Determine Jose's self-employment tax for 2018.

Definitions:

Bone Cells

Specialized cells that make up bone tissue, responsible for the creation, maintenance, and repair of bone.

Diaphysis

The shaft or central part of a long bone, located between the bone's two ends.

Yellow Bone Marrow

A type of bone marrow primarily composed of fat cells, found in the cavities of long bones, and plays a role in the storage of fats.

Tarsals

A group of seven small bones that form the ankle and proximal part of the foot.

Q2: Which of the following would not be

Q14: What effect do the UNICAP rules generally

Q31: Legal income shifting includes shifting income among

Q52: All of the following are acceptable methods

Q72: A flat tax generally would be considered

Q73: Stephanie, a taxpayer in the 24% marginal

Q77: When income is taxed in a different

Q87: MACRS depreciation

Q89: For a 21-year-old child to be considered

Q89: The contribution limit for a defined contribution