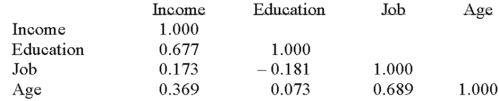

The following correlations were computed as part of a multiple regression analysis that used education,job,and age to predict income.  Which independent variable has the strongest association with the dependent variable?

Which independent variable has the strongest association with the dependent variable?

Definitions:

Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) is the rate at which the net present value of all the cash flows (both positive and negative) from a project or investment equals zero, used as a benchmark to decide the profitability of an investment.

Net Present Value (NPV)

NPV is a financial metric used in capital budgeting to assess the profitability of an investment or project, calculated as the difference between the present value of cash inflows and outflows.

Capital Budgeting

The process by which investors or company management evaluate and select long-term investments that are likely to yield positive returns.

Long-Term Effects

The lasting outcomes or impacts that result from a specific action or event, considered over an extended period of time.

Q2: The F distribution is a _ distribution.

Q16: Refer to the information provided for Nue

Q28: For a contingency table,the expected frequency for

Q42: If there is absolutely no relationship between

Q72: The average cost of tuition,room and

Q87: In a study of protein breakfast

Q88: A manager at a local bank analyzed

Q93: A Type I error is the probability

Q119: Twenty-one executives in a large corporation were

Q125: An ANOVA table for multiple regression has