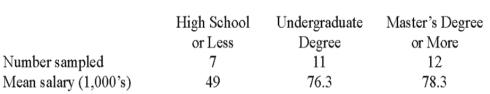

A random sample of 30 executives from companies with assets over $1 million was selected and asked for their annual income and level of education.The ANOVA comparing the average income among three levels of education rejected the null hypothesis.The Mean Square Error (MSE) was 243.7.The following table summarized the results:  Based on the comparison between the mean annual incomes for executives with Undergraduate and Master's Degree or more,

Based on the comparison between the mean annual incomes for executives with Undergraduate and Master's Degree or more,

Definitions:

Call Option

An option contract granting the holder the privilege to buy an asset at a predetermined strike price until the expiration date.

Stock Price

The current price at which a share of a company is being traded on the stock market.

Exercise Price

Another term for strike price, specifically the price at which an option or warrant can be executed.

Put Option

An agreement allowing the owner the option, yet not the requirement, to sell a predetermined quantity of a foundational asset at an agreed price during a defined period.

Q2: In a multiple regression ANOVA table,explained variation

Q23: It is claimed that in a

Q31: A group of statistics students decided to

Q33: The following correlations were computed as part

Q38: A chart that shows the relationship between

Q42: There is not one,but a family of

Q73: In cluster sampling,a population is divided into

Q74: The fifth and final step in testing

Q76: If we are testing for the difference

Q91: In multiple regression analysis,a residual is the