Jury Company wants to calculate the component costs in its capital structure. Common stock currently sells for $27, and is expected to pay a dividend of $0.50. Jury's dividend growth rate is 8%, and flotation cost is $1.25. Preferred stock sells for $46, pays a dividend of $4.00, and carries a flotation cost of $1.10. Jury Company bonds yield 9% in the market. Jury is in the 40% tax bracket.

Calculate cost of debt, cost of common stock, cost of new common stock, cost of preferred stock and cost of retained earnings.

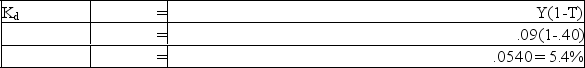

Cost of Debt (after tax)

Definitions:

Selling Prices

The amount of money charged for a product or service, determined by cost, competition, and market demand.

Unit Product Cost

The sum of materials, labor, and overhead expenses divided by the quantity of units manufactured.

Predetermined Overhead Rate

A rate used to apply manufacturing overhead to products or job orders, calculated before the production process begins.

Job-Order Costing

An accounting methodology used to assign costs to specific jobs or batches, enabling the calculation of profitability per job.

Q17: A bankers' acceptance:<br>A) is a draft drawn

Q31: You have an opportunity to buy a

Q35: If we assume that inventory is used

Q48: The net present value profile examines the

Q52: A decrease in investors' risk aversion causes

Q69: A firm's debt to equity ratio varies

Q73: When developing a credit scoring report, many

Q79: In a capital intensive economy, a shortage

Q91: You can purchase a strip bond at

Q147: D&B is known for providing:<br>A) interest rate