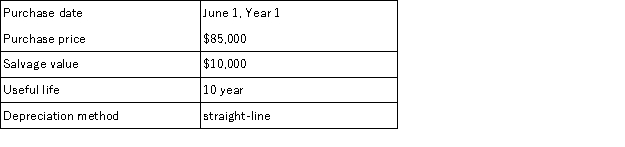

The following information is available on a depreciable asset owned by Mutual Savings Bank:  The asset's book value is $70,000 on June 1,Year 3.On that date,management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000.Based on this information,the amount of depreciation expense the company should recognize during the last six months of Year 3 would be:

The asset's book value is $70,000 on June 1,Year 3.On that date,management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000.Based on this information,the amount of depreciation expense the company should recognize during the last six months of Year 3 would be:

Definitions:

Below-Average Risk

Below-Average Risk indicates an investment or asset has a lower risk of loss compared to the average risk of the investment market or its relevant sector.

WACC

Weighted Average Cost of Capital; a measure of a firm's cost of capital in which each category of capital is proportionately weighted.

After-Tax Cost

The cost of a transaction or financial product after accounting for the effects of taxes on its overall expense.

Retained Earnings

The portion of a company's profits that is retained and reinvested in the company rather than distributed to shareholders as dividends.

Q3: At least one partner having a debit

Q3: Corporations issue preferred stock to raise capital

Q3: Lemming makes an $18,750,120-day,8% cash loan to

Q7: Santa Barbara Express has 4 sales employees,each

Q25: The _ method of accounting for bad

Q41: A company needed a new building.It found

Q44: _ is the amount of income earned

Q116: Partners' withdrawals are debited to their separate

Q124: Forman and Berry are forming a partnership.Forman

Q124: A machine costing $450,000 with a 4-year