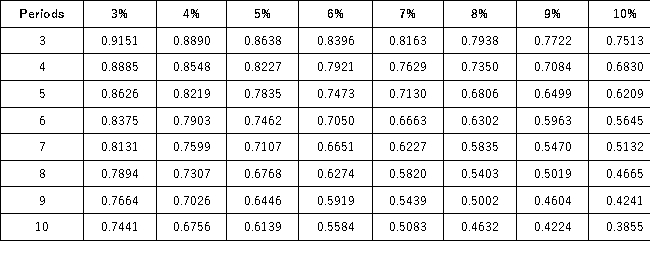

Present Value of 1  Future Value of 1

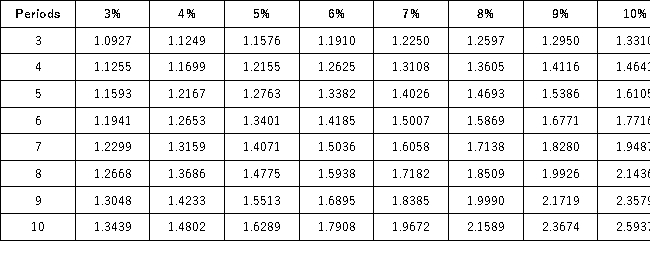

Future Value of 1  Present Value of an Annuity of 1

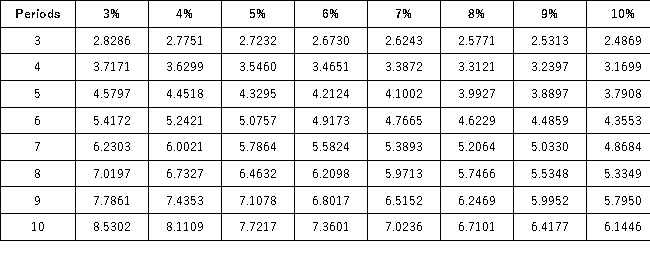

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company is considering investing in a project that is expected to return $350,000 four years from now.How much is the company willing to pay for this investment if the company requires a 12% return?

A company is considering investing in a project that is expected to return $350,000 four years from now.How much is the company willing to pay for this investment if the company requires a 12% return?

Definitions:

Specific Immune Responses

Immune reactions that are tailored to recognize and combat specific pathogens or biological invaders.

T-cells

A type of white blood cell crucial for the immune system, playing a central role in the immune response by attacking infected cells and tumors.

Phagocytosis

The process of engulfing and killing foreign particles.

Lymph Nodes

Small, bean-shaped structures in the lymphatic system, vital for the immune system, filtering substances and aiding in fighting infection.

Q5: A social audit is a systematic attempt

Q15: What differentiates a crisis from a problem?

Q23: The primary factor behind the transition from

Q36: The perceived validity or appropriateness of a

Q43: Which oftbe following is not an element

Q53: The journal is known as a book

Q108: If a company paid $38,000 of its

Q128: The heading on every financial statement lists

Q147: At a given point in time,a business's

Q179: Owner's equity is increased when cash is