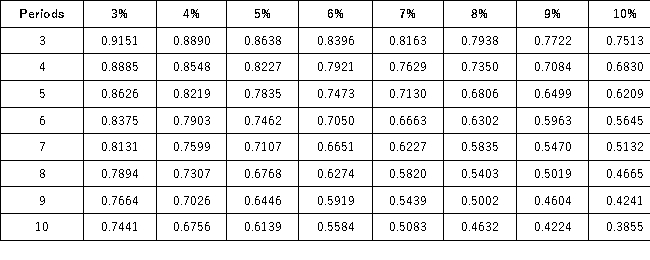

Present Value of 1  Future Value of 1

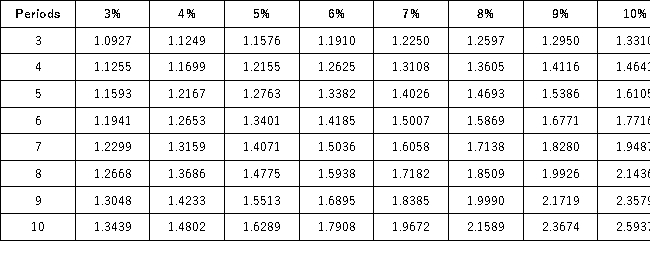

Future Value of 1  Present Value of an Annuity of 1

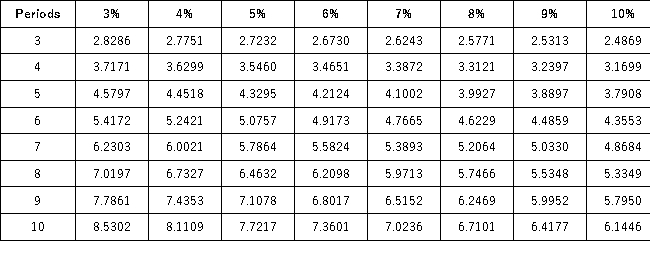

Present Value of an Annuity of 1  Future Value of an Annuity of 1

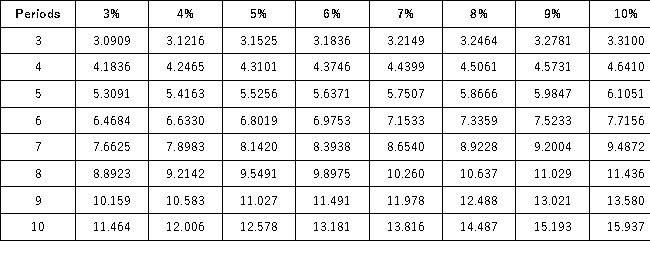

Future Value of an Annuity of 1  A company is considering an investment that will return $22,000 semiannually at the end of each semiannual period for 4 years.If the company requires an annual return of 10%,what is the maximum amount it is willing to pay for this investment?

A company is considering an investment that will return $22,000 semiannually at the end of each semiannual period for 4 years.If the company requires an annual return of 10%,what is the maximum amount it is willing to pay for this investment?

Definitions:

Rights Offering

A type of financial offering in which a company gives its existing shareholders the right to buy additional shares at a discounted price before the public.

Subscription Price

The cost for purchasing a subscription to a service or product, typically charged on a recurring basis.

Ownership Position

A stake or interest that a person or entity holds in a company, typically through the ownership of shares.

Ownership Position

A stake or interest that one holds in a company or property, often reflected by the amount of shares owned or the extent of investment.

Q1: What is the primary problem inherent in

Q4: The Generous Corporation argues that corporations began

Q10: Stakeholders who have a high potential for

Q44: An efficient issues management process will analyze

Q46: Why are inside directors seen as problematic

Q50: Once stakeholders have been identified,the firm can

Q57: _ explains changes in the owner's claim

Q109: If a company is considering the purchase

Q168: If a company purchases equipment costing $4,500

Q211: A company's balance sheet shows: cash $24,000,accounts