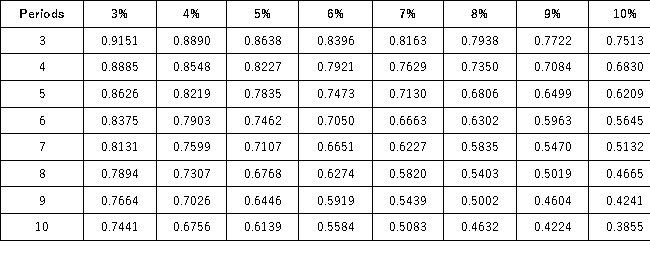

Present Value of 1  Future Value of 1

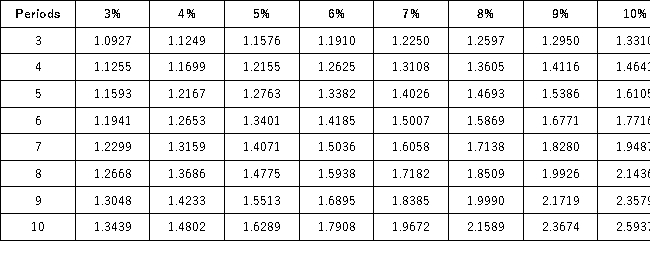

Future Value of 1  Present Value of an Annuity of 1

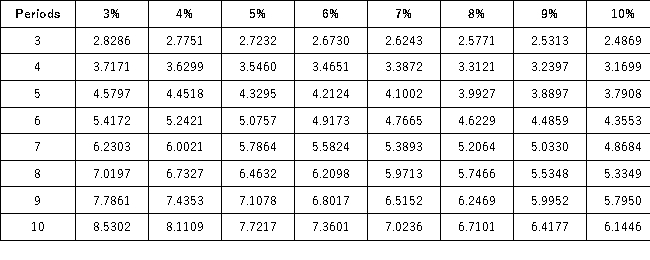

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  Interest may be defined as:

Interest may be defined as:

Definitions:

Standard Hours

The predetermined amount of time expected to complete a task or produce a unit of product under normal conditions.

Total Standard Cost

The aggregated cost of direct materials, direct labor, and manufacturing overhead used in producing a product under standard costing.

Standard Cost

The planned cost for a unit of product or service, serving as a benchmark for evaluating performance and setting budgets.

Net Operating Income

The profit a company makes after deducting its operating expenses, without accounting for taxes and interest.

Q8: Which of the following did not contribute

Q25: The overarching strategy level that asks what

Q28: If insurance coverage for the next two

Q30: If a company has excess space in

Q30: Which of the following is not a

Q56: Directors who have no ties to the

Q66: Affiuence refers to the level of wealth,disposable

Q142: Dawson Electronic Services had revenues of $80,000

Q155: The _ is a record containing all

Q171: A company's formal promise to pay (in