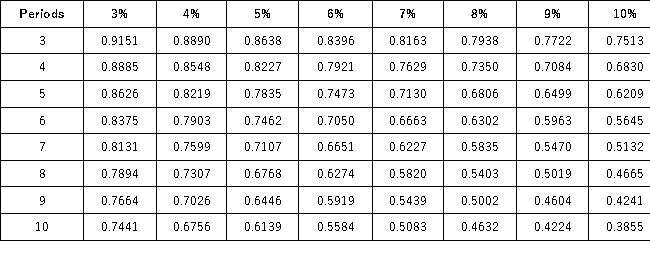

Present Value of 1  Future Value of 1

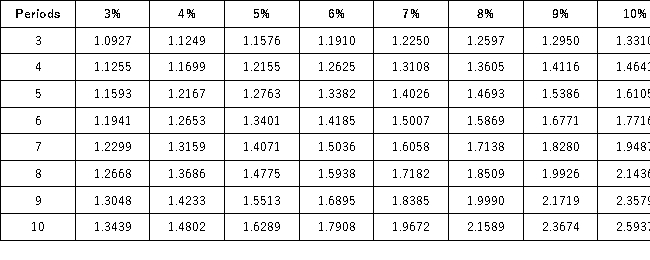

Future Value of 1  Present Value of an Annuity of 1

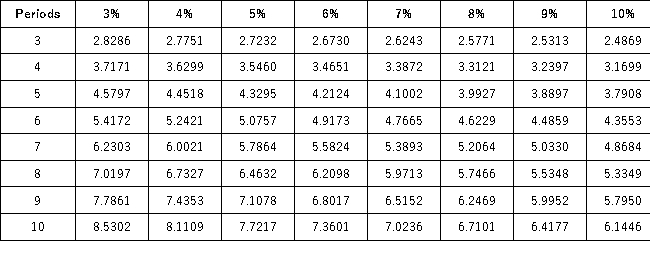

Present Value of an Annuity of 1  Future Value of an Annuity of 1

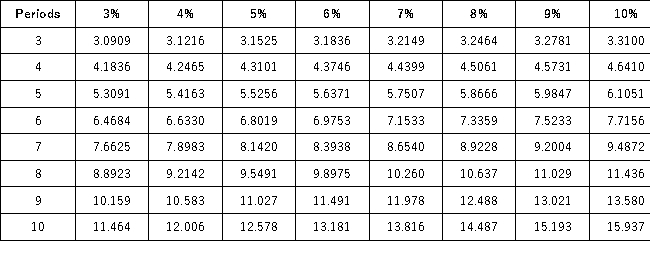

Future Value of an Annuity of 1  Which interest rate column would you use from a present value or future value table for 8% interest compounded quarterly?

Which interest rate column would you use from a present value or future value table for 8% interest compounded quarterly?

Definitions:

Cognitive Development

The process of growth and change in intellectual/cognitive abilities such as thinking, reasoning, and understanding.

Discrete Stages

Distinct phases in development or processes that are clearly separated from one another, often with very different characteristics or functions.

Movement

The act or process of moving; in a broader context, it can refer to physical activities, migration, or social movements aiming for change.

Early Speech

The initial stages of acquiring and developing language skills, typically observed in toddlers as they begin to form words and simple sentences.

Q10: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q13: Drew Castle is an insurance appraiser.Shown below

Q13: Personal liability for a corporate board member

Q17: The best stage at which to address

Q19: "In the long run,those who do not

Q59: Congruence between the organization's activities and society's

Q60: Explain Harry Markopolos' opinion regarding the SEC.

Q69: A major distinction between the managerial view

Q132: Jarrod Automotive,owned and operated by Jarrod Johnson,began

Q208: If assets are $99,000 and liabilities are