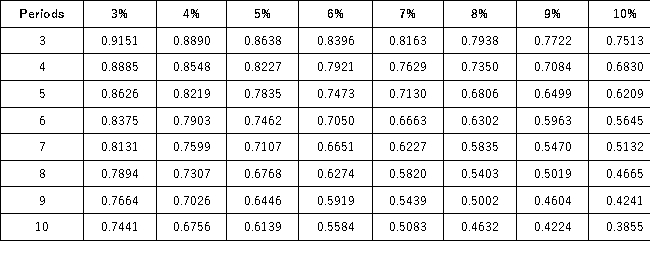

Present Value of 1  Future Value of 1

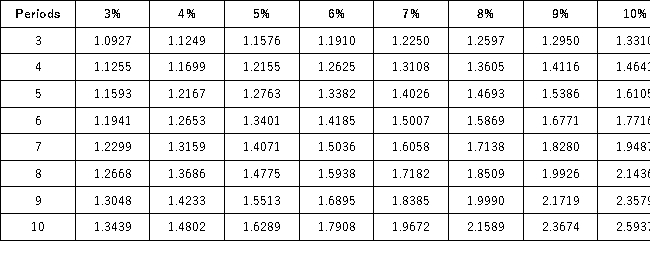

Future Value of 1  Present Value of an Annuity of 1

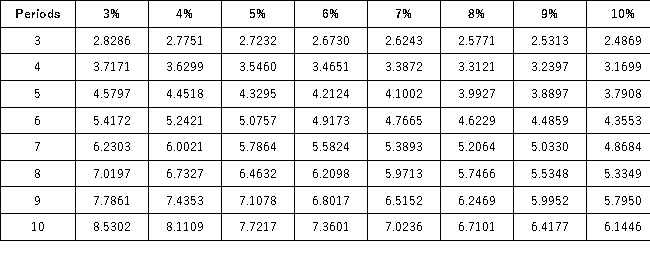

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  A company is considering investing in a project that is expected to return $350,000 four years from now.How much is the company willing to pay for this investment if the company requires a 12% return?

A company is considering investing in a project that is expected to return $350,000 four years from now.How much is the company willing to pay for this investment if the company requires a 12% return?

Definitions:

Risk-Free Rate

The return on an investment with no risk of financial loss, typically associated with government bonds.

Expected Inflation

The anticipated rate at which prices of goods and services will rise over a period.

Spot Rate

The prevailing market rate at which a specific asset is available for purchase or sale with immediate effect.

Real Rate

The interest rate adjusted for inflation, reflecting the true cost of borrowing and the true return on lending.

Q6: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q7: Which of the following is not listed

Q17: The most important stakeholders of a business

Q43: Which oftbe following is not an element

Q60: Explain Harry Markopolos' opinion regarding the SEC.

Q104: A common characteristic of _ is their

Q117: The owner's claim on assets,also known as

Q123: Technology:<br>A)Has replaced accounting.<br>B)Has not improved the clerical

Q131: The accounting principle that requires accounting information

Q147: At a given point in time,a business's