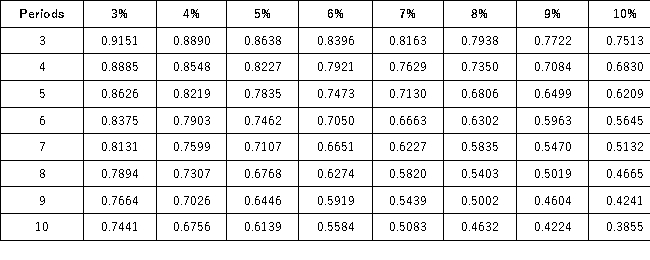

Present Value of 1  Future Value of 1

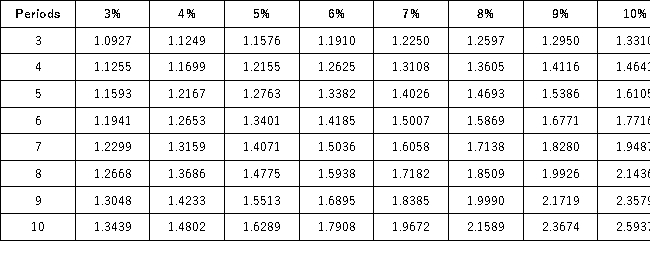

Future Value of 1  Present Value of an Annuity of 1

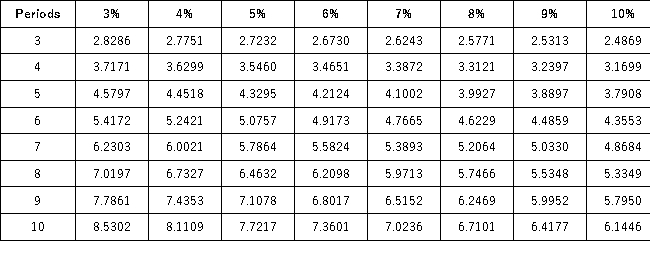

Present Value of an Annuity of 1  Future Value of an Annuity of 1

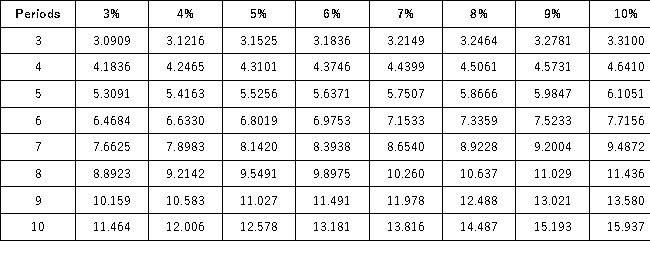

Future Value of an Annuity of 1  A company is considering an investment that will return $22,000 semiannually at the end of each semiannual period for 4 years.If the company requires an annual return of 10%,what is the maximum amount it is willing to pay for this investment?

A company is considering an investment that will return $22,000 semiannually at the end of each semiannual period for 4 years.If the company requires an annual return of 10%,what is the maximum amount it is willing to pay for this investment?

Definitions:

Positive Emotions

Feelings that are enjoyable or pleasurable, such as happiness, joy, or love.

Negative Emotions

Feelings such as sadness, anger, fear, or disgust that are often associated with unpleasant or harmful experiences.

Feedback System

A process or mechanism that uses the output or result of a system to regulate or control its future activity or input.

Affective Forecasting

The process of predicting one's emotional reactions to future events or outcomes.

Q11: Some businesses are socially responsible;other businesses do

Q17: Social performance reports help companies<br>A)By disrupting their

Q28: If we consider the stakeholder typology,and the

Q34: Investing activities are the acquiring and disposing

Q42: Understanding generally accepted accounting principles is not

Q108: The second step in the analyzing and

Q152: Willow Rentals purchased office supplies on credit.The

Q195: A business's source documents:<br>A)include the ledger.<br>B)Provide objective

Q226: The income statement reports all of the

Q233: Cage Company had income of $350 million