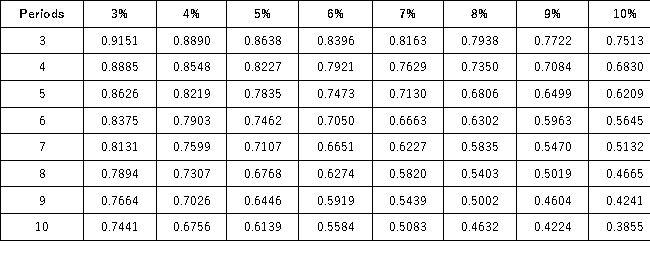

Present Value of 1  Future Value of 1

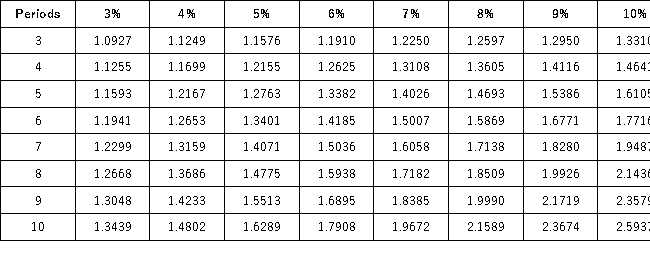

Future Value of 1  Present Value of an Annuity of 1

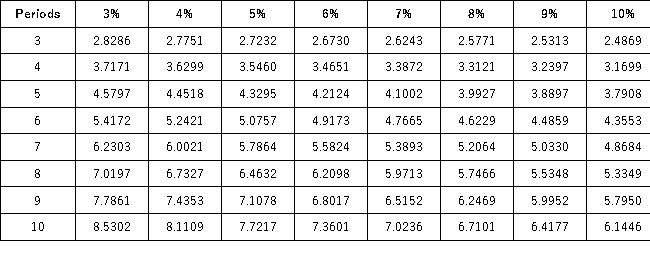

Present Value of an Annuity of 1  Future Value of an Annuity of 1

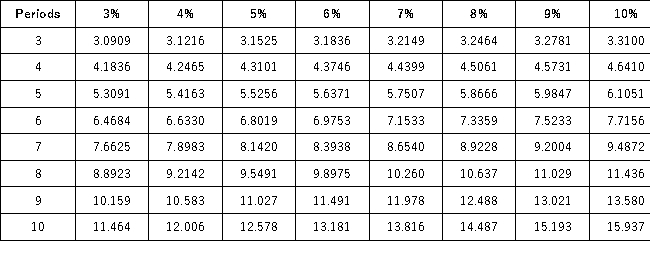

Future Value of an Annuity of 1  Jackson has a loan that requires a $17,000 lump sum payment at the end of four years.The interest rate on the loan is 5%,compounded annually.How much did Jackson borrow today?

Jackson has a loan that requires a $17,000 lump sum payment at the end of four years.The interest rate on the loan is 5%,compounded annually.How much did Jackson borrow today?

Definitions:

Par Value

This term denotes the officially stated value of a share of stock or bond, serving as a legal capital threshold that companies cannot issue stock below.

Current Market Value

The amount of money that could currently be received for selling an asset in the marketplace.

Par-value

The face value of a bond or the stated value of a stock, as defined in the corporate charter, which has little to do with its market value.

Yield To Maturity

The total return anticipated on a bond if it is held until its maturity date, taking into account its purchase price, interest payments, and terminal value.

Q13: Mirkle Corporation uses the following activity rates

Q15: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q36: One of the biggest advances in corporate

Q62: All of the following statements regarding a

Q70: At year-end,a trial balance showed total credits

Q77: Assets are the resources a company owns

Q129: A record containing all the separate accounts

Q163: As a general rule,revenues should not be

Q186: _ documents identify and describe transactions and

Q193: Risk is:<br>A)Net income divided by average total