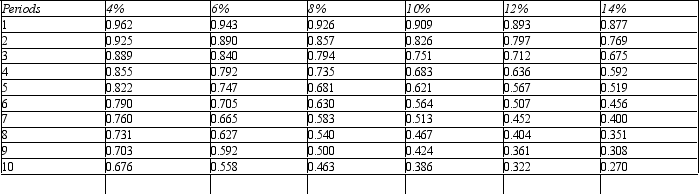

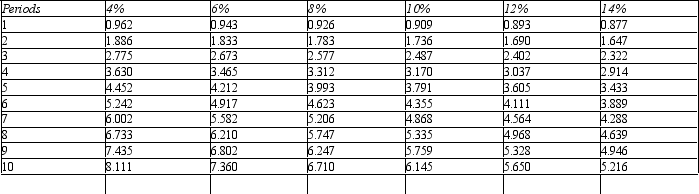

Figure 14-10.

Present value of $1

Present value of an Annuity of $1

Present value of an Annuity of $1

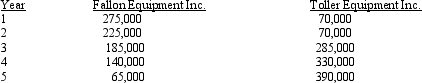

Refer to Figure 14-10.Ray Corporation is looking to invest in a new piece of equipment.Two manufacturers of this type of equipment are being considered.After-tax inflows for the two competing projects are:

Refer to Figure 14-10.Ray Corporation is looking to invest in a new piece of equipment.Two manufacturers of this type of equipment are being considered.After-tax inflows for the two competing projects are:

Both projects require an initial investment of $400,000.In both cases,assume that the equipment has a life of five years with no salvage value.

Both projects require an initial investment of $400,000.In both cases,assume that the equipment has a life of five years with no salvage value.

Required:

A.Assuming a discount rate of 8 percent,compute the net present value of each piece of equipment.

B.A third option is now available for a supplier outside of the country.The cost is also $400,000,but it will produce even cash flows over its five-year life.What must the annual cash flow be for this equipment to be selected over the other two? Assume an 8 percent discount rate.

Definitions:

Myelin

A fatty substance that surrounds nerves, providing insulation and helping to speed neural transmission.

Scar Tissue

The fibrous tissue that forms over a wound as it heals, replacing normal skin or tissue but lacking the original structure's full function.

Sodium-Potassium Pump

A cell membrane protein that pumps sodium ions out and potassium ions into cells, essential for maintaining cell potential and volume.

Actively Move

The process of initiating motion or action by deliberate effort and energy.

Q17: The _ measures the aggregate effect of

Q30: The internal rate of return is defined

Q40: Holt Company reported the following on its

Q53: An important qualitative factor to consider regarding

Q64: Abbott Company is considering purchasing a new

Q66: A static budget is<br>A)considered a good choice

Q79: Several transfer pricing policies are used in

Q126: If year one equals $800,000,year two equals

Q137: Which budget is used to assess managerial

Q141: Figure 12-4. Quinn Inc.has a number of