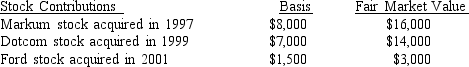

What is Beth's maximum allowable deduction for the following contributions to qualified public charities during the current year if her adjusted gross income is $90,000?

Definitions:

Framing Effect

The cognitive bias where people's decisions are influenced by the way information is presented rather than the information itself.

Relatively Cheap

A term used to describe goods or services that are considered to be priced lower than their perceived value or compared to alternative options.

Prospect Theory

A psychological theory that describes how people choose between probabilistic alternatives that involve risk, where the probabilities of outcomes are known.

"Low Fat" Sour Cream

Sour cream that has been modified to contain a lower fat content than traditional sour cream.

Q6: A corporation owns 90 percent of the

Q6: Gribble Corporation acquires the Dibble Corporation for

Q8: Describe a difference between the RNA polymerases

Q12: _ 15.If property is distributed to a

Q14: Explain why a eukaryotic mRNA that has

Q29: Assume that a base addition occurs early

Q38: Ultraviolet light causes pyrimidine dimers to form

Q42: A sole shareholder receives a piece of

Q50: Refer to the information in Table 1.What

Q56: Which of the following does not apply