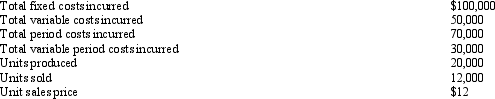

Sheets Corporation The following information was extracted from the first year absorption-based accounting records of Sheets Corporation Refer to Sheets Corporation.If Sheets Corporation had used variable costing in its first year of operations,how much income (loss) before income taxes would it have reported?

Refer to Sheets Corporation.If Sheets Corporation had used variable costing in its first year of operations,how much income (loss) before income taxes would it have reported?

Definitions:

Net Income

The total profit of a company after all expenses, taxes, and costs have been deducted from total revenue.

Income Tax Expense

The amount of money a company or individual owes to the government based on the taxable income for a given period.

Average Collection Period

The average number of days it takes for a business to collect its accounts receivable.

Accounts Receivable

Money owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.

Q14: Downsizing may result in a(n)<br>A)reduction in workforce.<br>B)restructuring

Q30: What are the principles of open-book management?

Q39: The ISO 9000 standards<br>A)indicate which companies' products

Q53: When using the high-low method,fixed costs are

Q115: Product complexity refers to the number of

Q116: A cost that remains constant in total

Q123: If production exceeds sales,absorption costing net income

Q158: In a job-order costing system,the dollar amount

Q190: In a normal cost system,factory overhead is

Q191: Absorption costing conforms with generally accepted accounting