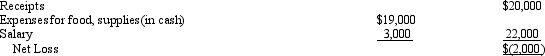

The Evans Company has been operating a small lunch counter for the convenience of employees.The counter occupies space that is not needed for any other business purpose.The lunch counter has been managed by a part-time employee whose annual salary is $3,000.Yearly operations have consistently shown a loss as follows:

A company has offered to sell Evans Company automatic vending machines for a total cost of $12,000.Sales terms are cash on delivery.The old equipment has zero disposal value.

A company has offered to sell Evans Company automatic vending machines for a total cost of $12,000.Sales terms are cash on delivery.The old equipment has zero disposal value.

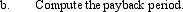

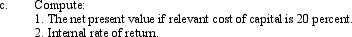

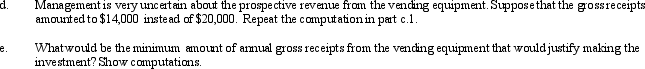

The predicted useful life of the equipment is 10 years,with zero scrap value.The equipment will easily serve the same volume that the lunch counter handled.A catering company will completely service and supply the machines.Prices and variety of food and drink will be the same as those that prevailed at the lunch counter.The catering company will pay 5 percent of gross receipts to the Evans Company and will bear all costs of food,repairs,and so forth.The part-time employee will be discharged.Thus,Evans Company's only cost will be the initial outlay for the machines.

Consider only the two alternatives mentioned.Present value tables or a financial calculator are required.

Required:

Definitions:

Compulsions

Repetitive behaviors or mental acts that an individual feels driven to perform in response to an obsession, or according to rigid rules.

Post-Traumatic Stress Disorder

A psychological disorder resulting from direct exposure to or observation of a horrifying incident, characterized by reoccurring flashbacks, distressing dreams, and intense fear.

Recurrent Dreams

Dreams that repeatedly occur over time, often reflecting underlying themes or unresolved issues in an individual's life.

Vietnam War Veterans

Individuals who served in the military forces during the Vietnam War, a prolonged conflict that took place from 1955 to 1975, involving North Vietnam and its allies against South Vietnam and its allies, including the United States.

Q11: The payback method typically assumes that all

Q23: Residual income is an example of a

Q37: Broncho Sports Enterprises The Football Division of

Q46: When a project is chosen from a

Q58: Davis Corporation<br>Davis Corporation manufactures and sells baseball

Q118: For an ordinary annuity,the first cash flow

Q126: The net present value method of evaluating

Q129: The flow of goods through a production

Q138: The _ is the highest rate of

Q189: Non-financial performance measures (NFPMs)are better than financial