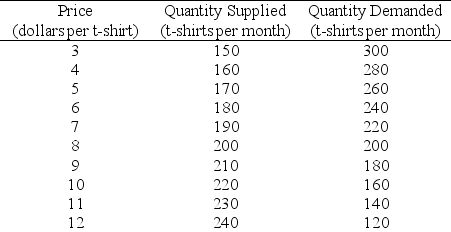

Use the table below to answer the following questions.

Table 3.5.3

Demand and supply schedules for designer sport t-shirts at CoolU

-Refer to Table 3.5.3.The equilibrium price is $________ and the equilibrium quantity is ________ t-shirts per month.

Definitions:

Deferred Tax Assets

The amounts of income taxes recoverable in future periods in respect of deductible temporary differences, carryforward of unused tax losses, and carryforward of unused tax credits.

Taxable Temporary Difference

The difference between the tax base of an asset or liability and its carrying amount in the financial statements that will result in taxable amounts in future periods.

Deferred Tax Asset

An accounting term that refers to a situation where a company has paid more taxes to the government than it has shown as an expense in its financial statements, leading to future tax savings.

Deferred Tax Liability

A tax obligation that a company owes but is allowed to pay at a later date, often due to timing differences between accounting practices and tax laws.

Q14: Household employers are not required to pay

Q44: Refer to Figure 5.3.1.The efficient quantity is<br>A)250

Q59: In 2013,Marc,a single taxpayer,has ordinary income of

Q62: Given Fact 2.4.1,Andy and Rolfe<br>A)can gain from

Q80: If a large percentage fall in the

Q88: Refer to Figure 6.3.2.Between 200 and 300

Q129: Consider the following household.In 5 hours,Bob can

Q137: Monika will choose to eat a seventh

Q141: Which of the following is true regarding

Q172: Which one of the following topics does