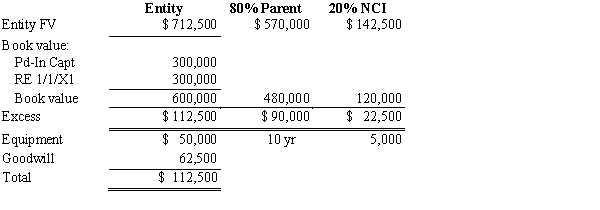

Company S has been an 80%-owned subsidiary of Company P since January 1, 20X7. The determination and distribution of excess schedule prepared at the time of purchase was as follows:

On January 2, 20X9, Company P issued $120,000 of 8% bonds at face value to help finance the purchase of 25% of the outstanding common stock of Alpha Company for $200,000. No excess resulted from this transaction. Alpha earned $100,000 net income during 20X7 and paid $20,000 in dividends.

On January 2, 20X9, Company P issued $120,000 of 8% bonds at face value to help finance the purchase of 25% of the outstanding common stock of Alpha Company for $200,000. No excess resulted from this transaction. Alpha earned $100,000 net income during 20X7 and paid $20,000 in dividends.

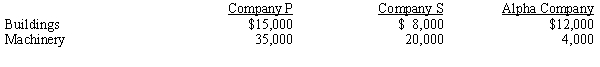

The only change in plant assets during 20X9 was that Company S sold a machine for $10,000. The machine had a cost of $60,000 and accumulated depreciation of $40,000. Depreciation expense recorded during 20X7 was as follows:

The 20X9 consolidated income was $180,000, of which the NCI was $10,000. Company P paid dividends of $12,000, and Company S paid dividends of $10,000.

The 20X9 consolidated income was $180,000, of which the NCI was $10,000. Company P paid dividends of $12,000, and Company S paid dividends of $10,000.

Consolidated inventory was $287,000 in 20X8 and $223,000 in 20X9; consolidated current liabilities were $246,000 in 20X8 and $216,700 in 20X9. Cash increased by $205,700.

Required:

Using the indirect method and the information provided, prepare the 20X9 consolidated statement of cash flows for Company P. and its subsidiary, Company S.

Definitions:

Production Costs

Expenses directly related to the creation and manufacturing of a product, including raw materials, labor, and overhead.

Explicit Costs

These are direct, out-of-pocket payments for expenses incurred by a business, such as wages, rent, and materials.

Opportunity Costs

The cost of foregoing the next best alternative when a decision is made to pursue a particular action.

Total Revenues

The total amount of money received by a company from its sales of goods or services, before any expenses are subtracted.

Q6: Explain the long-term adaptations made by the

Q7: In an 80% purchase accounted for as

Q12: When a blood capillary is cut, a

Q19: As expenses are made in compliance with

Q19: What are the two primary approaches to

Q23: On January 1, 20X1, Parent Company acquired

Q29: The determination and distribution schedule for the

Q34: Following is a list of selected transactions

Q36: Use this figure to answer the corresponding

Q49: For the following questions, choose the