PROBLEM

Scenario 3-4

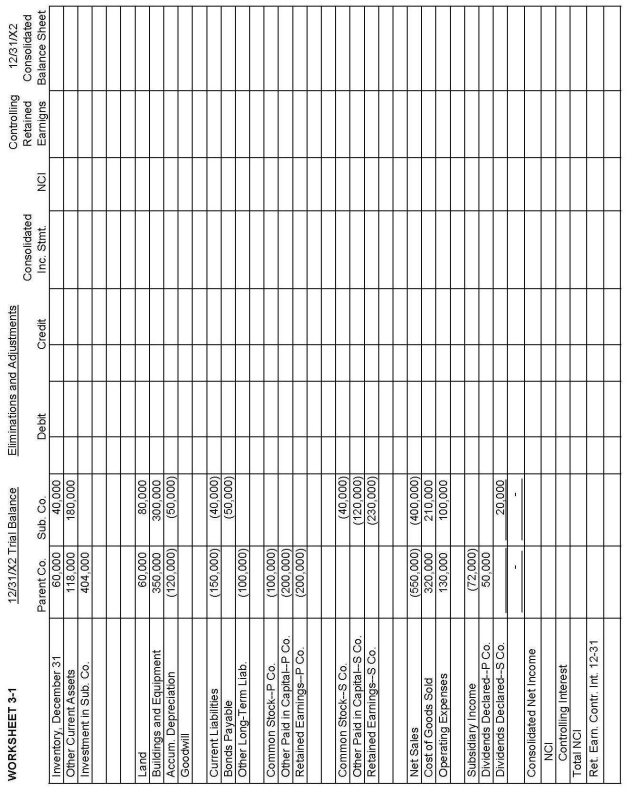

On January 1, 20X1, Parent Company purchased 80% of the common stock of Subsidiary Company for $316,000. On this date, Subsidiary had common stock, other paid-in capital, and retained earnings of $40,000, $120,000, and $190,000, respectively. Net income and dividends for 2 years for Subsidiary Company were as follows:

On January 1, 20X1, the only tangible assets of Subsidiary that were undervalued were inventory and building. Inventory, for which FIFO is used, was worth $5,000 more than cost. The inventory was sold in 20X1. Building, which was worth $15,000 more than book value, has a remaining life of 8 years, and straight-line depreciation is used. Any remaining excess is goodwill.

On January 1, 20X1, the only tangible assets of Subsidiary that were undervalued were inventory and building. Inventory, for which FIFO is used, was worth $5,000 more than cost. The inventory was sold in 20X1. Building, which was worth $15,000 more than book value, has a remaining life of 8 years, and straight-line depreciation is used. Any remaining excess is goodwill.

-Refer to Scenario 3-4 and Worksheet 3-1.

Required:

a. Complete the consolidating worksheet for December 31, 20X2.

b. Prepare supportive Income Distribution Schedules for Subsidiary and Parent.

Definitions:

Accounts Receivable

Money owed to a company by its customers from sales or services rendered on credit, recorded as an asset on the balance sheet.

Accounts Payable

Liabilities of a business arising from credit purchases from suppliers, displayed on the company's balance sheet as money owed.

Assets Sold

The sale of company assets, which could include equipment, properties, or other resources owned by the company.

Owner's Equity

The residual interest in the assets of an entity after deducting liabilities, representing the ownership interest.

Q4: Complete each of the following statments.<br>_ refers

Q8: Consolidated financial statements are appropriate even without

Q10: Phelps Co. uses the sophisticated equity method

Q17: Consolidation procedures for Sale-Type Leases:<br>A) allow for

Q18: In which of the following circumstances surrounding

Q19: Account balances are as of December 31,

Q26: When a city plans to build a

Q27: A manufacturer produced a good with a

Q40: Under new governmental standards, which of the

Q88: Edema refers to excess interstitial fluid.