Scenario 2-1

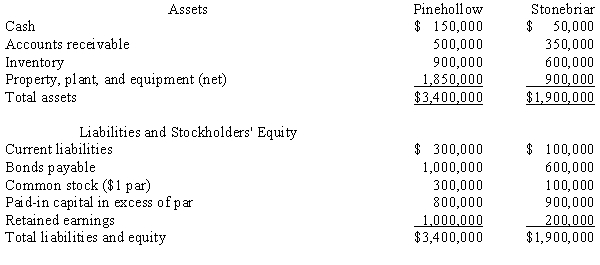

Pinehollow acquired all of the outstanding stock of Stonebriar by issuing 100,000 shares of its $1 par value stock. The shares have a fair value of $15 per share. Pinehollow also paid $25,000 in direct acquisition costs. Prior to the transaction, the companies have the following balance sheets:

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively.

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively.

-Refer to Scenario 2-1. Goodwill associated with the purchase of Stonebriar is ____.

Definitions:

Marital Status

A legal or social recognition of a person's current state regarding marriage, such as single, married, divorced, or widowed.

Salary Expectations

The amount of money or compensation a person anticipates receiving as a wage or salary for their job or position.

Previous Employer

The company or individual for whom someone worked in the past, often referred to as part of background checks or job applications.

Technical Interview Questions

Questions designed to assess a candidate's technical knowledge or skillset related to a specific job or field.

Q11: Beginning in 1999<br>A) only gifts to U.S.

Q16: Which one of the following statements is

Q17: Matt and Jeff organized their partnership on

Q25: If the investment in subsidiary account is

Q26: Explain why governmental funds use budgetary accounts.

Q27: When an U.S. investor entity acquires interest

Q32: Wolters Corporation is a U.S. corporation

Q45: Complete each of the following statments.<br>_ tissue

Q54: The following selected transactions affecting the Annuity

Q161: For the following questions, choose the