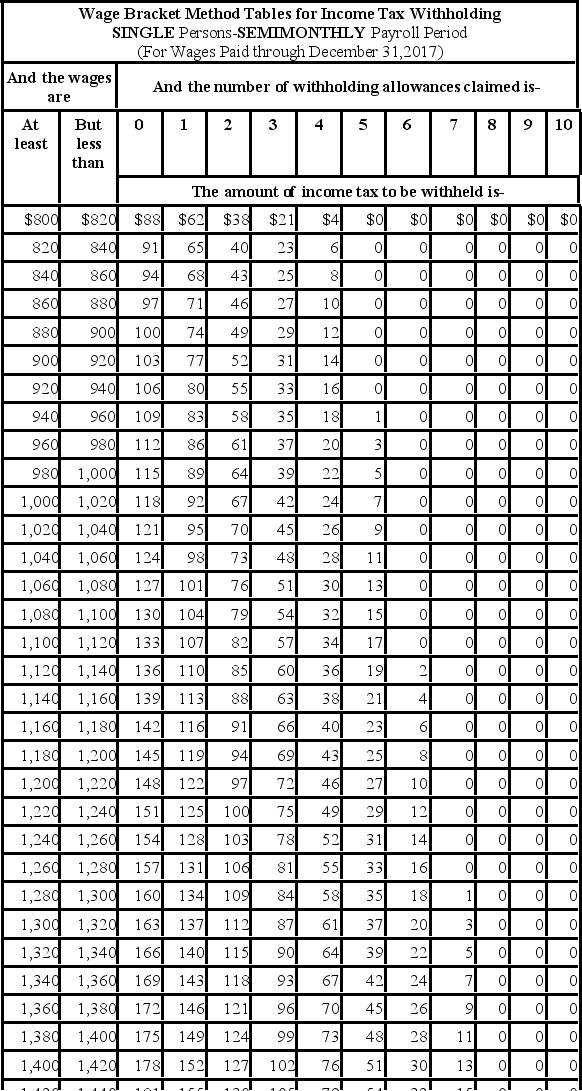

Max earned $1,019.55 during the most recent semimonthly pay period. He is single with 1 withholding allowance and has no pre-tax deductions. Using the following table, how much should be withheld for federal income tax?

Definitions:

Cost-to-retail Ratio

A method used in retail to calculate the cost of merchandise sold, calculated by dividing the cost of goods by the retail price.

Net Markdowns

The total decrease in the selling price of merchandise over a period, minus any markdown cancellations or recoveries.

Freight-in Charges

Costs incurred in bringing inventory to its present location and condition, typically including transportation charges.

LIFO Retail Inventory Method

An inventory costing method that assumes the last items placed in inventory are sold first, not necessarily reflecting the actual physical flow of merchandise.

Q12: Which Act extended medical benefits for certain

Q25: Compared with women, men are more likely

Q32: The central route tends to be rational,

Q55: The purpose of the net pay and

Q55: The classification of workers as exempt and

Q65: The ethical principle of due care pertains

Q73: The experience of vivid geometric images and

Q81: Compared with the structuralists, early behaviorists were

Q107: Which perspective highlights the reproductive advantages of

Q107: Adoptive parents are LEAST likely to influence