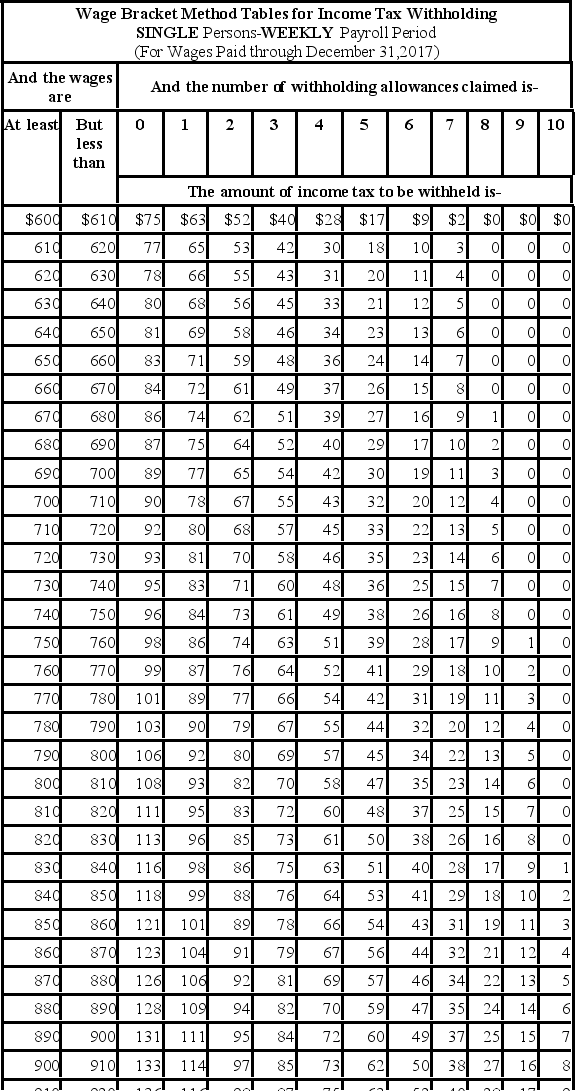

Andie earned $680.20 during the most recent weekly pay period. She is single with 3 withholding allowances and needs to decide between contributing 2.5% and $25 to her 401(k) plan. If she chooses the method that results in the lowest taxable income, how much will be withheld for Federal income tax (based on the following table) ?

Definitions:

Windows Operating System

A series of graphical operating systems developed, marketed, and sold by Microsoft.

Version

A specific form or variation of a product that is different from other forms of the same product or from previous iterations.

Variable Costs

Costs that change in proportion with the level of output or business activity, in contrast to fixed costs.

Profit per Unit

The difference between the selling price of a product and its cost per unit.

Q1: Julio is single with 1 withholding allowance.

Q8: Which of the following was NOT cited

Q9: Collin is a full-time exempt employee in

Q25: Define "reframing explanations."

Q26: Which of the following reports links the

Q32: The purpose of using combination pay methods

Q69: Cocaine is classified as a(n)<br>A) hallucinogen.<br>B) stimulant.<br>C)

Q71: Which of the following parties does not

Q72: As of the June 11 pay date,

Q84: Temperament refers to a person's characteristic<br>A) emotional