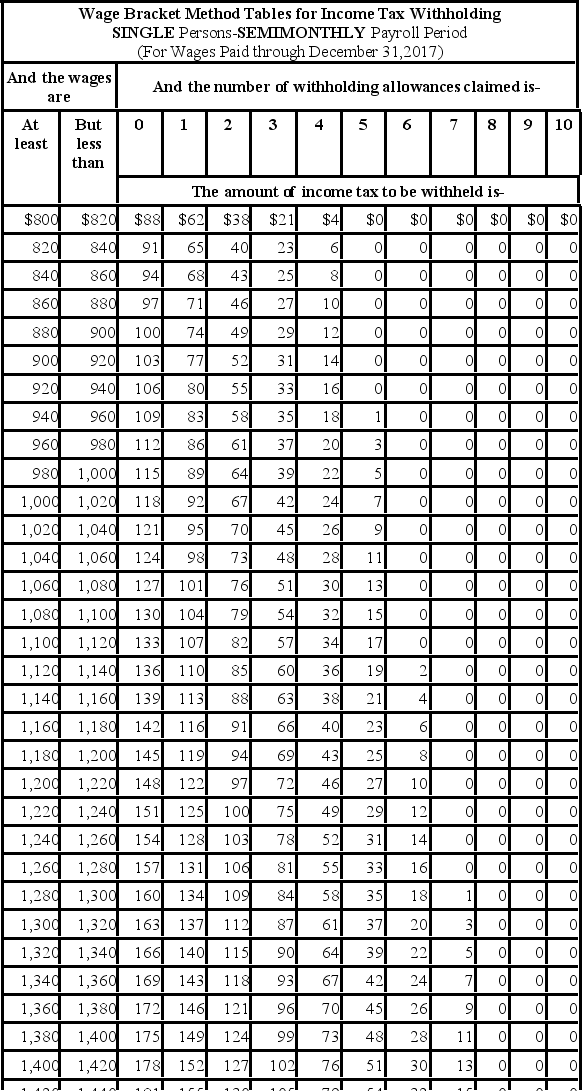

Julio is single with 1 withholding allowance. He earned $1,025.00 during the most recent semimonthly pay period. He needs to decide between contributing 3% and $30 to his 401(k) plan. If he chooses the method that results in the lowest taxable income, how much will be withheld for Federal income tax (based on the following table) ?

Definitions:

Q14: A nonexempt, salaried worker who received $46,500

Q14: Schedule B must accompany Form 941 for

Q19: What effect do payroll entries have on

Q24: It is important that the payroll accountant

Q30: All employee contributions to qualified Premium-Only Plans

Q35: Language of a very high intensity is

Q41: Which items must be contained in every

Q74: Which of the following are important decisions

Q76: Morphine and heroin are<br>A) amphetamines.<br>B) opiates.<br>C) hallucinogens.<br>D)

Q82: Salaried employees may be classified as nonexempt.