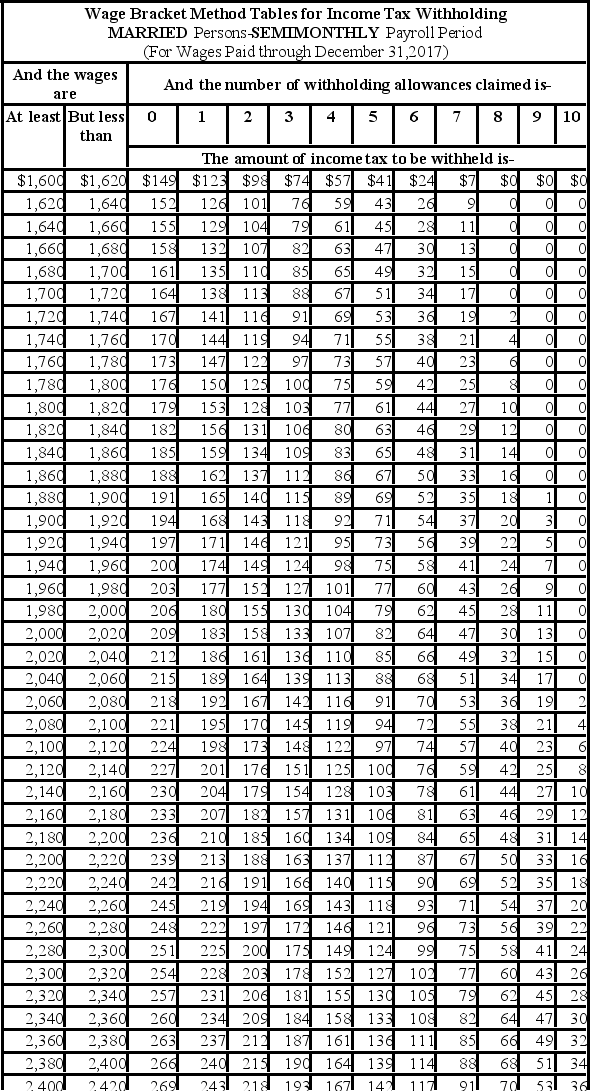

Trish earned $1,734.90 during the most recent semimonthly pay period. She is married and has 3 withholding allowances and has no pre-tax deductions. Based on the following table, how much should be withheld from her gross pay for Federal income tax?

Definitions:

Job Security

The confidence or probability that a person will maintain their employment without facing unemployment risks.

Securities Law

The area of law dealing with the regulation of securities (stocks, bonds, etc.), protecting investors, ensuring fair trading, and preventing fraud.

Mutual Acceptance

The initial stage in team development when members begin to accept and understand each other.

Diagnose Conflict

The process of identifying the underlying reasons for a disagreement or clash between parties.

Q9: In which order are transactions listed in

Q10: Which of the following are types of

Q17: To estimate trait heritability, researchers are most

Q35: Adam is a nonexempt employee who is

Q49: Which of the following financial report(s) reflect

Q69: Within how many days after initially commencing

Q72: Evolutionary psychologists attribute gender differences in sexuality

Q75: William James was a prominent American<br>A) psychoanalyst.<br>B)

Q80: The heritability of a specific trait will

Q82: Salaried employees may be classified as nonexempt.