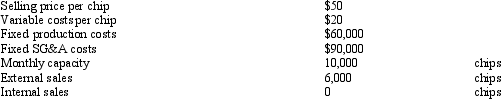

Infobytes Corporation Infobytes Corporation manufactures and sells various high-tech office automation products. Two divisions of Infobytes Corporation are the Computer Chip Division and the Computer Division. The Computer Chip Division manufactures one product, a "super chip," that can be used by both the Computer Division and other external customers. The following information is available on this month's operations in the Computer Chip Division: Presently, the Computer Division purchases no chips from the Computer Chips Division, but instead pays $45 to an external supplier for the 4,000 chips it needs each month.

Presently, the Computer Division purchases no chips from the Computer Chips Division, but instead pays $45 to an external supplier for the 4,000 chips it needs each month.

Refer to Infobytes Corporation. Assume that next month's costs and levels of operations in the Computer and Computer Chip Divisions are similar to this month. What is the minimum of the transfer price range for a possible transfer of the super chip from one division to the other?

Definitions:

Beta

A measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole, with a value greater than 1 indicating higher risk and a value less than 1 indicating lower risk.

Treynor Measure

A metric for assessing the returns of an investment portfolio, adjusting for the risk taken as measured by beta.

Beta

A measure of a stock's volatility in comparison to the overall market's volatility, indicating the risk associated with investing in the stock.

Serial Correlation

The relationship between a data series and a lagged version of itself over consecutive time intervals.

Q14: What are five ways that an organization

Q22: The definition of a sunk cost is<br>A)

Q29: A cost management system should provide information

Q37: An organization's strategy is the guiding force

Q59: A responsibility accounting system should include the

Q104: A linear programming model must<br>A) have only

Q121: Responsibility reports reflect the flow of information

Q155: Which of the following would be an

Q165: Which of the following types of employee

Q170: The Educational Toy Corporation produces puzzles in