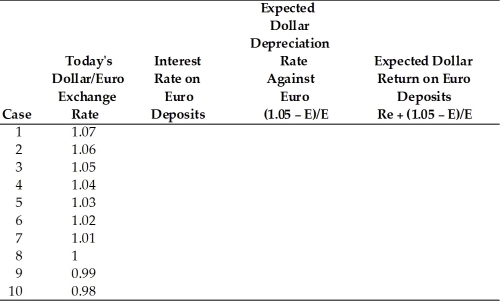

Assume that the euro interest rate is constant at 5 percent, and that the expected exchange rate is 1.05 dollars per one euro. Find the expected dollar return on euro deposits for the following cases.

Definitions:

Full-cost Method

A method of accounting for all expenditures associated with the exploration and development of oil and gas reserves as capitalized costs, which are then amortized over the total volume of proven resources.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board that is globally accepted for financial reporting.

Operating Asset

An Operating Asset is an asset used by a company in its day-to-day operations to generate revenue, such as machinery, buildings, or equipment.

Components

Parts or elements that make up a larger system or compound.

Q3: For almost 70 years international trade policies

Q6: Government purchases are defined as<br>A) only goods

Q19: Find the real exchange rate for the

Q40: It has been claimed that foreign governments

Q60: Explain why price levels are lower in

Q61: A short update on a current project

Q65: Which of the following statements is the

Q72: In long-run equilibrium after a permanent money-supply

Q76: How do interviewers test applicants for logical

Q86: In the short run, an increase in