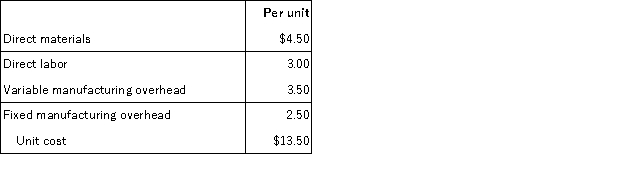

Deer currently manufactures a subcomponent that is used in its main product. A supplier has offered to supply all the subcomponents needed at a price of $12. Deer currently produces 80,000 subcomponents at the following manufacturing costs:  a. If Deer has no alternative uses for the manufacturing capacity, what would be the profit impact of buying the subcomponents from the supplier?

a. If Deer has no alternative uses for the manufacturing capacity, what would be the profit impact of buying the subcomponents from the supplier?

b. If Deer has no alternative uses for the manufacturing capacity, what would be the maximum price per unit they would be willing to pay the supplier?

c. Now assume Deer would avoid $120,000 in equipment leases and salaries if the subcomponent were purchased from the supplier. Now what would be the profit impact of buying from the supplier?

Definitions:

Merchandise

Goods that are bought and sold by businesses; also refers to the commodities or products available for sale in retail or wholesale.

Total Value

The entire worth of an asset, portfolio, or company, factoring in all components of value.

Perpetual Inventory System

An inventory management system that updates inventory records for each purchase and sale transaction in real-time.

FIFO

An inventory valuation method that assumes the first items placed in inventory are the first sold, hence "First In, First Out."

Q2: Which of the following best defines a

Q10: Which of the following relationships is correct?<br>A)

Q12: If a scattergraph contains points that do

Q26: Costs that change across decision alternatives are:<br>A)

Q45: Last month Carlos Company had a $60,000

Q53: Top-down budgeting is:<br>A) when the local managers

Q59: Pine Corp. has revenues of $500,000 resulting

Q100: Harbor Images has collected the following cost

Q101: The difference between the actual variable overhead

Q106: Spice Company has two divisions, Parsley and