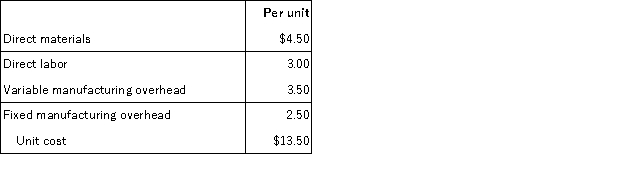

Deer currently manufactures a subcomponent that is used in its main product. A supplier has offered to supply all the subcomponents needed at a price of $12. Deer currently produces 80,000 subcomponents at the following manufacturing costs:  a. If Deer has no alternative uses for the manufacturing capacity, what would be the profit impact of buying the subcomponents from the supplier?

a. If Deer has no alternative uses for the manufacturing capacity, what would be the profit impact of buying the subcomponents from the supplier?

b. If Deer has no alternative uses for the manufacturing capacity, what would be the maximum price per unit they would be willing to pay the supplier?

c. Now assume Deer would avoid $120,000 in equipment leases and salaries if the subcomponent were purchased from the supplier. Now what would be the profit impact of buying from the supplier?

Definitions:

Specific Identification Method

An inventory valuation method where costs are directly assigned to individual units of inventory, enabling precise profit margin calculations.

Inventory Valuation

The method used to determine the cost associated with an inventory at the end of a financial period, which affects cost of goods sold and, consequently, net income.

Net Income

The net income of a company following the deduction of all taxes and expenses from the gross revenue.

FIFO Cost Flow

An inventory valuation method in which the costs of the earliest goods purchased are the first to be recognized in determining cost of goods sold.

Q2: Which of the following best defines a

Q4: Sparrow, Inc. used the high-low method to

Q17: Magnolia Company has identified seven activities as

Q46: Which of the following is not something

Q56: Maple Inc. manufactures a product that costs

Q89: When a traditional, volume-based costing system is

Q90: Edna Inc. has forecast its sales for

Q108: Devon Inc. has a profit margin of

Q115: Warner Company has budgeted fixed overhead of

Q116: Which of the following is not a