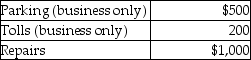

Brittany,who is an employee,drove her automobile a total of 20,000 business miles in 2016.This represents about 75% of the auto's use.She has receipts as follows:  Brittany's AGI for the year of $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method.After application of any relevant floors or other limitations,Brittany can deduct

Brittany's AGI for the year of $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method.After application of any relevant floors or other limitations,Brittany can deduct

Definitions:

Code Of Ethics

A set of principles and guidelines designed to help professionals conduct business honestly and with integrity.

Crashing

A project management technique used to reduce the time for task completion by increasing the allocation of resources, often leading to higher costs.

CPM Network

A project management tool that uses critical path method (CPM) principles to model the activities and events of a project in a graphical network.

Critical Path

A sequence of critical tasks in a project timeline that need timely completion to ensure the project ends on its scheduled date.

Q15: Xenon has a molar heat of vaporization

Q16: If the volume of a confined gas

Q19: Potassium crystallizes in a body-centered cubic unit

Q25: Which of the following is the smallest

Q32: On August 1 of the current year,Terry

Q36: 30.0 g H<sub>2</sub>O at an unknown temperature

Q41: The destruction of a capital asset due

Q44: Use VSEPR theory to predict the molecular

Q55: Mr.and Mrs.Gere,who are filing a joint return,have

Q64: If an employee incurs business-related entertainment expenses