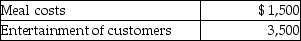

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Definitions:

Bearer

An individual in possession of an instrument, such as a check or bond, that is not made out to a specific payee.

Certified Cheque

A cheque guaranteed by a bank, indicating that the funds are available and have been set aside for the payee.

Bill Drawn

A document requesting the payment of money, typically used in international trade, specifying the amount and terms of payment.

Drawee

is the party, often a bank, required to pay the monetary amount specified in a check or draft.

Q9: Discuss the timing of the allowable medical

Q10: How many possible resonance structures exist for

Q18: The standard molar enthalpy of formation of

Q19: Polyethylene is a polymer consisting of only

Q26: Steven is a representative for a textbook

Q30: Distinguish between the accrual-method taxpayer and the

Q47: Determine the heat of reaction for

Q85: Mara owns an activity with suspended passive

Q124: Tucker (age 52)and Elizabeth (age 48)are a

Q127: A partnership plans to set up a