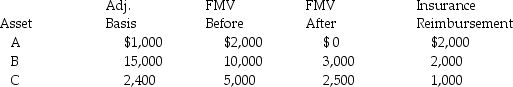

Wes owned a business which was destroyed by fire in May 2016.Details of his losses follow:

His AGI without consideration of the casualty is $45,000.

His AGI without consideration of the casualty is $45,000.

What is Wes's net casualty loss deduction for 2016?

Definitions:

No Crowds

The absence of a large group of people gathered together, often implying a place or situation that is not busy or congested.

Shopping Malls

Large indoor complexes that house a wide variety of retail stores, eateries, and often entertainment facilities.

Noisy

Characterized by or making a lot of sound, especially of a kind that is unpleasant or disturbing.

Modern Features

Current and advanced characteristics or facilities provided by technology or services.

Q19: Two isotopes of a given element will

Q45: Soft drink bottles are made of polyethylene

Q67: Atkon Corporation acquired 90% of the stock

Q74: There are several different types of qualified

Q93: Meals may be excluded from an employee's

Q95: Why did Congress enact restrictions and limitations

Q108: A fire totally destroyed office equipment and

Q125: Tobey receives 1,000 shares of YouDog! stock

Q132: Taxpayers may deduct lobbying expenses incurred to

Q139: Explain when educational expenses are deductible for