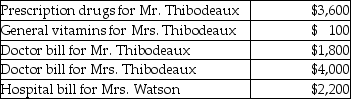

Mr.and Mrs.Thibodeaux (both age 35) ,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.  Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Modeling

A learning process where individuals learn and replicate behaviors by observing and imitating others.

Mirror Neurons

Neurons that fire both when an individual performs an action and when they observe the same action performed by another, thought to be involved in empathy, learning by imitation, and understanding others’ actions.

Frontal Lobe

The part of the brain located at the front of each cerebral hemisphere, responsible for voluntary movement, expressive language, and managing executive functions.

Motor Cortex

An area at the rear of the frontal lobes that controls voluntary movements.

Q3: Identify the oxidizing and reducing agents in

Q31: The radius of a potassium atom is

Q45: Write a balanced half-reaction for the reduction

Q59: Which of the following expenses or losses

Q66: Alan,who is a security officer,is shot while

Q67: Travel expenses related to temporary work assignments

Q79: A taxpayer sells an asset with a

Q88: Fees paid to prepare a taxpayer's Schedule

Q111: Leigh pays the following legal and accounting

Q117: Taxpayers may not deduct interest expense on