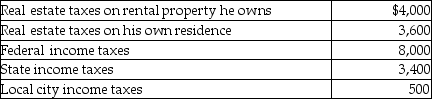

Arun paid the following taxes this year:  What amount can Arun deduct as an itemized deduction on his tax return?

What amount can Arun deduct as an itemized deduction on his tax return?

Definitions:

Paid Leave

Employer-provided time off work that is compensated, including for reasons such as vacation, illness, or family care.

Leave Time

An allotted period of time during which an employee is allowed to be away from work, often for specific reasons such as health or personal matters.

National Labor Relations Act

Federal labor legislation consisting of the Wagner and Taft-Hartley acts.

Interpreted

Understood or explained the meaning of something, typically in the context of language, texts, or actions.

Q28: Melanie,a single taxpayer,has AGI of $220,000 which

Q29: Which of the following item(s)must be included

Q30: Brienne sells land to her brother,Abe,at a

Q33: Under the wash sale rule,if all of

Q34: Valeria owns a home worth $1,400,000,with a

Q58: Gina is an instructor at State University

Q67: Liz,who is single,lives in a single family

Q82: Daniel's cabin was destroyed in a massive

Q83: Sacha,a dentist,has significant investment assets.She holds corporate

Q116: Expenses paid with a credit card are