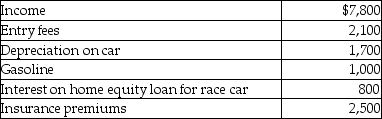

Kyle drives a race car in his spare time and on weekends.His records regarding this activity reflect the following information for the year.  What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

Definitions:

Budgeted Manufacturing

The process of estimating future production costs, including materials, labor, and overhead, for a specific period.

Manufacturing Overhead

Indirect factory-related costs that are incurred when producing a product, which can include utilities, maintenance, and factory equipment depreciation.

Variable

An element, feature, or factor that is likely to vary or change; it could also refer to costs that fluctuate with the level of output.

Fixed Costs

Costs that do not vary with the level of production or sales, such as rent or salaries, providing predictability for budgeting.

Q9: Ben,age 67,and Karla,age 58,have two children who

Q28: Speak Corporation,a calendar year accrual-basis taxpayer,sell packages

Q36: Aaron found a prototype of a new

Q64: A married person who files a separate

Q74: Nicole has a weekend home on Pecan

Q78: The definition of medical care includes preventative

Q81: Joy purchased 200 shares of HiLo Mutual

Q84: Edward purchased stock last year as follows:

Q102: During the current year,Charlene borrows $10,000 to

Q131: During the current year,Jack personally uses his