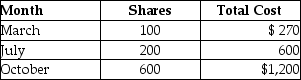

Edward purchased stock last year as follows:  In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

Definitions:

Revenue Earned

The total amount of income generated by the sale of goods or services related to the company's primary operations.

Home Soccer Games

Sporting events played at a team's home venue, attracting local attendance and generating revenue.

Warranty Expense

An estimated cost that a company expects to incur for the repair or replacement of a product during its warranty period.

Upholstery Materials

These are fabrics, paddings, and springs used to cover and cushion furniture.

Q1: Under the accrual method,recurring liabilities may be

Q2: The filing status in which the rates

Q38: The maximum tax deductible contribution to a

Q47: A charitable contribution deduction is allowed for

Q55: For purposes of the dependency exemption,a qualifying

Q74: During the current year,Lucy,who has a sole

Q75: Ross works for Houston Corporation,which has a

Q84: Business investigation expenses incurred by a taxpayer

Q128: "Gross income" is a key term in

Q131: In a community property state,jointly owned property