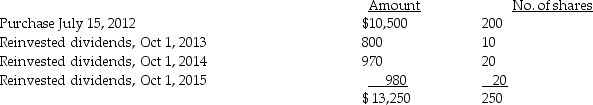

Joy purchased 200 shares of HiLo Mutual Fund on July 15,2012,for $10,500,and has been reinvesting dividends.On December 15,2016,she sells 100 shares.

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

Definitions:

Data Mart

A subject-oriented database that addresses a specific business line or team within an organization, and is a subset of a data warehouse.

Data Warehouses

Centralized repositories that store large amounts of integrated data from multiple sources, designed for query and analysis rather than transaction processing.

Access Database

A database management system from Microsoft that combines the relational Microsoft Jet Database Engine with a graphical user interface and software-development tools.

Field Size Property

A characteristic in database management that defines the maximum amount of data that can be stored in a particular field.

Q15: Mike won $700 in a football pool.This

Q26: For purposes of the application of the

Q29: Explain the rules for determining whether a

Q29: In the Current Model,investment earnings are taxed

Q42: Cafeteria plans are valuable to employers because<br>A)they

Q71: In December 2016,Max,a cash-basis taxpayer,rents an apartment

Q75: A married taxpayer may file as head

Q81: Ivan's AGI is about $50,000 this year,and

Q81: Paige is starting Paige's Poodle Parlor and

Q97: All of the following are true with